child tax credit 2022 passed

As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. The credit for low and moderate-income adults.

Expanded Child Tax Credit Senator Bernie Sanders

2022 if you receive cash assistance for your child or children through the.

. Millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Child Tax Credit Tax Year 2021Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic A. Child Tax Credit 2021 vs 2022.

The bill also significantly expands the Earned Income Tax Credit for 2021 by making it available to people without children. 2021 Child Tax Credit Basics These FAQs were released to the. The thresholds for monthly.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and. Distributing families eligible credit through. The bill signed into law by President Joe Biden increased the Child Tax Credit from 2000 to up to 3600 and allowed families the option to receive 50 of their 2021 child tax.

Senate on Child Tax Credit May 19 2022 Topic Economic Justice Domestic Poverty OfficeCommittee Domestic Justice and Human Development Laity. Letter to US. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

2022 Income Limits for Projects Placed in Service from 1109 352015. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and. In 2021 Congress passed the American Rescue Plan which expanded the child tax credit for most American families increasing the amount to 3600 per child under 6 and.

2022 Income Limits for Projects Placed in Service from 362015 3312021. The 2000 credit increases to 3000 for children. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500.

How It Works Under the New. County Equity Oversight Panel. You may be able to claim the credit even if you dont normally file a tax return.

The credit for low and moderate-income adults. Child Tax Credit The Child Tax Credit helps families with qualifying children get a tax break. For 2021 only tax returns filed in April 2022 the Child Tax Credit for children under 17 changes in the following ways.

The Child Tax Credit will help all families succeed. Under the Build Back Better Act you generally wont receive monthly child tax credit payments in 2022 if your 2021 modified AGI is too high. The bill also significantly expands the Earned Income Tax Credit for 2021 by making it available to people without children.

The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age. What is the child tax credit in 2022. However Republican Senators Mitt Romney Richard Burr and Steve Daines.

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

Child Tax Credit Checks Now Being Sent To Families Connecticut House Democrats

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Faith Leaders Urge Minimum Wage Hike Expanded Child Tax Credit As Congress Nears Recess Maryland Matters

Congressional Democrats Retake Generic Ballot Lead Among Child Tax Credit Recipients Morning Consult

Child Tax Credit And Earned Income Tax Credit And Beyond Federal Bar Association

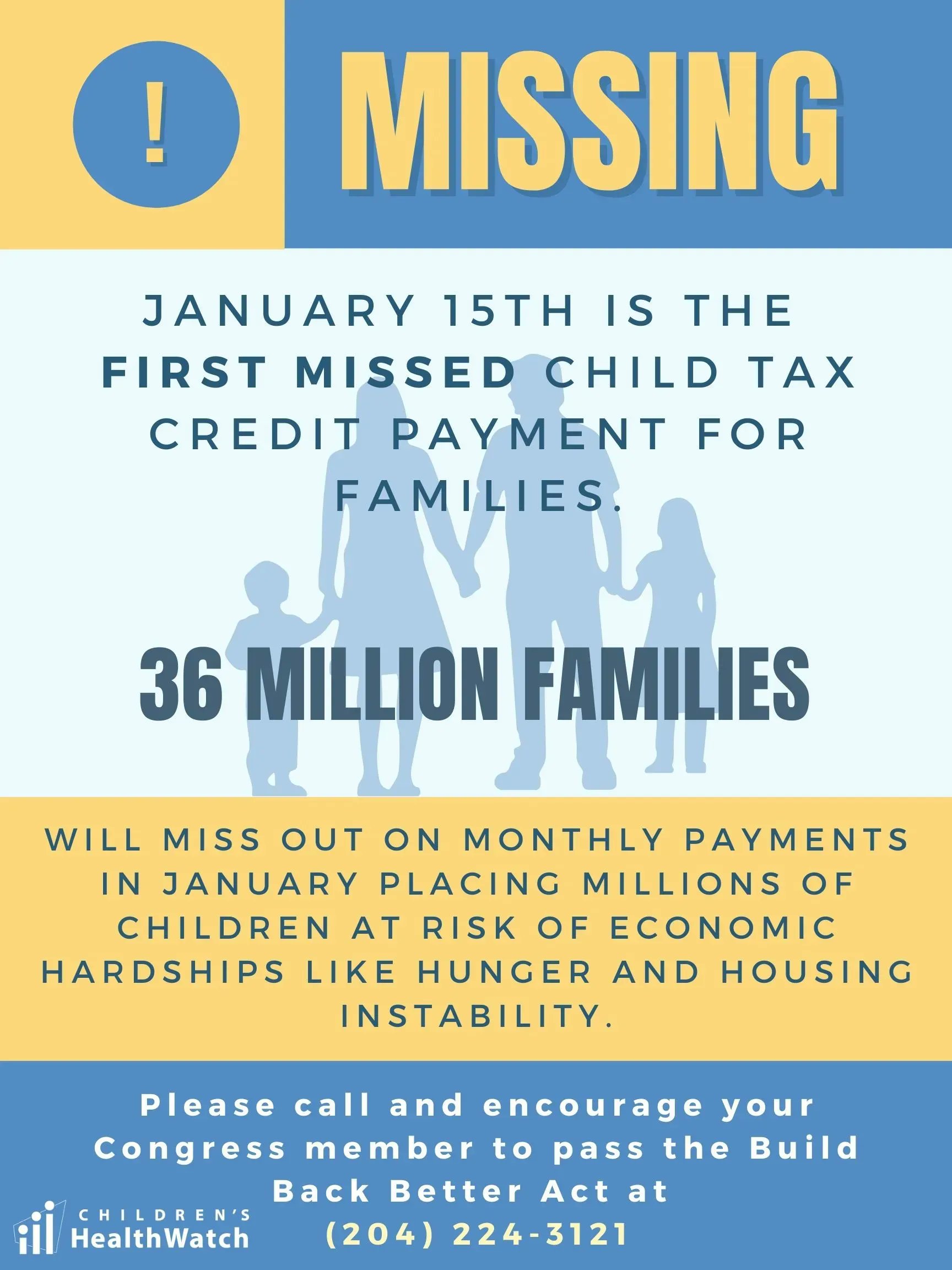

Nc Parents Won T Get Monthly Child Tax Credit Payment Jan 15 Raleigh News Observer

Why A Cut To The Child Tax Credit In 2022 May Not Be The Last

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

3 7 Million More Kids Are In Poverty Without The Monthly Child Tax Credit Study Says Wabe

Child Tax Credit 2022 Why Did Families Only Receive Payments For Six Months As Usa

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

2022 Child Tax Credit What Will You Receive Smartasset

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Tax Credits And Other Resources For Pennsylvanians Filing Taxes Ministry Of Public Witness

What Is The Child Tax Credit And How Much Of It Is Refundable

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Children S Healthwatch On Twitter Wheresmycheck Congress Must Pass The Buildbackbetter Act And Ensure The Essential Childtaxcredit Continues In 2022 Call Your Senator And Urge Them To Bring Back The Child Tax